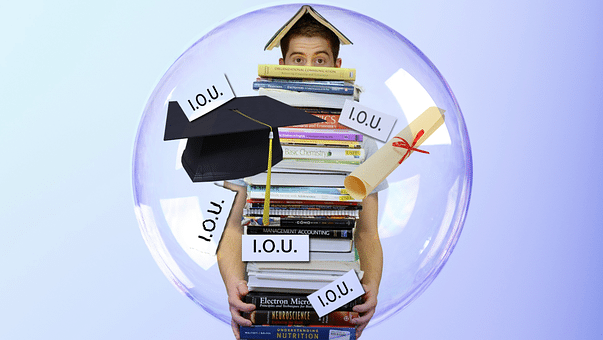

Tackling your student loan debt

Every year students collect loan debt as they gear up to face the real world. In the United states, students loan debt has jumped nearly 150 percent in the last decade, reaching an all-time high of $1.4 trillion as undergrads owe an average debt of $40K. According to a recent survey by SoFi, 83 percent of respondents reportedly shared feelings of anxiety and depression due to their student loan debts. The survey also showed that not only is causing recent grads to lose sleep (34 percent) it is also stopping over 42 percent from moving forward by putting off major life decisions like starting a family or buying a home due to their debt. That is why The Hype magazine and SoFi think it important that you know what you owe so that you can pay attention to your long-term goals. Know your earning potential and consider refinancing and value the importance of budgeting and saving.

How much of a burden is student loan debt to millennials?

Unfortunately, student loans are a huge burden on the millennial generation. In 2016, the average graduate walked that stage with $34,000 in student loan debt. According to a recent sofa survey, about 40 percent of people will stay in a job that they hate just because of their student loan debt. But one thing I personally find really interesting as a millennial is that 75 percent of people will actually give up social media for an entire year if it means getting rid of their student loan debt while 50 percent of people unfortunately experience anxiety or feelings of depression when it comes to their student loan debt. Another 15 percent of those folks actually seek help from mental health professionals to handle that depression and anxiety.

What are some strategic steps to help students tackle student loan debt?

The first thing you got to do is face those numbers and that can often be the hardest part, but you have to sit down and look up exactly how much debt you have, who your servicers are, what those interest rates are and the minimum payments. Once you have all that information you can start to formulate an attack plan. For some people, that’s looking at federal options such as income driven repayment plans or forgiveness programs but for others refinancing actually makes a lot of sense and some people actually do a little bit of both.

Why is it so important for recent grads to refinance college loans now?

For those recent grads who left college back in May or June, that six-month grace period is now coming to an end. It is time to start making those payments on the student loans which means it’s time to start formulating a plan. Now one of the recommendations I would have about refinancing is if you look into doing it early. That means you can reduce your interest rate early and save a lot of money over the course of your loans. The average sofa member actually saves around $300 per month after refinancing and that’s over $22,000 during the course of student loan repayment which is a ton of money.

What are some other important tips for recent grads who are trying to get their financial life together?

One of the big ones for recent grads all the way through anyone who’s just trying to get a handle on their money is knowing your cash flow and I’ll admit, that’s actually just a fancy way to say you have to have a budget. But knowing how much money is coming in, how much money is going out and the difference. That is what can give you the ability to make informed decisions about your financial life. Now the other things you got to do is think about things beyond your student loan debt. What are your short, medium and long term financial goals?

Are you starting to plan for retirement? Even in your early 20s, you need to be looking into things like your 401k options. Do you have an employer match? The big thing too is automating your savings. There are so many people out there who think like — oh I can only save five or ten dollars per paycheck, what’s the point? The point truthfully is building that habit. Building a habit early is going to be a lot more valuable to you in the long run as opposed to trying to make a complete lifestyle shift in a decade or two and you think you’ve got it a little bit more under control.

So where can our viewers go for more information?

If you need more information on how to refinance your student loans you should go to Sofi.com to learn all about how to refinance your student loan debt.

Tweet