Wells Fargo Invests in Six Black-Owned Banks

Investment is part of a $50 million pledge to help minority institutions and the bank’s larger commitment to foster an inclusive recovery

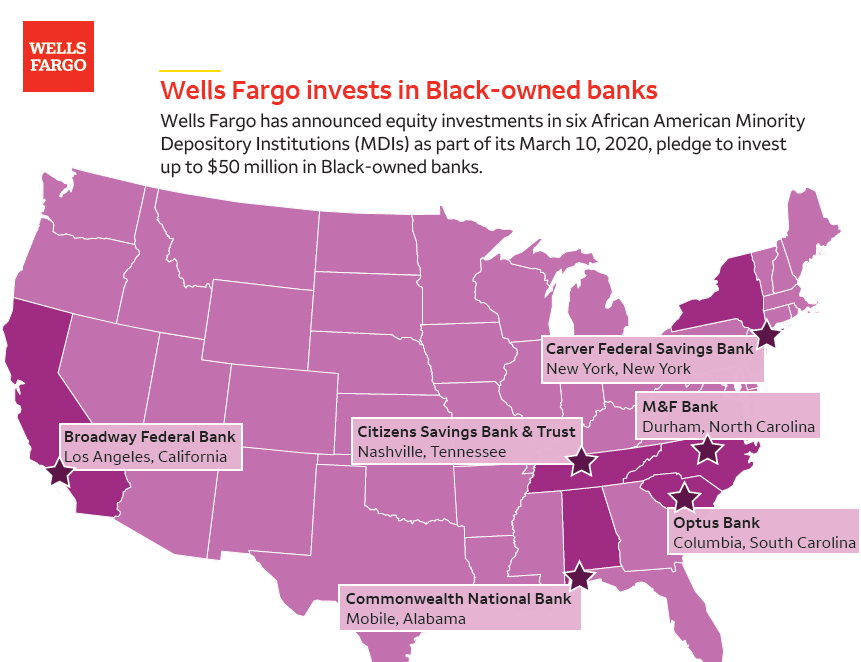

Wells Fargo today announced equity investments in six African American Minority Depository Institutions (MDIs) as part of its March 10, 2020, pledge to invest up to $50 million in Black-owned banks. As part of the capital investment, the banks will have access to a dedicated Wells Fargo relationship team that will provide financial, technological, and product development expertise in order to help each institution grow and benefit their local community. In the ongoing pandemic, communities of color have been disproportionately impacted, and this investment is part of Wells Fargo’s effort to generate a more inclusive recovery across the country.

“These investments are designed to help the banks become stronger and more impactful to the minority communities they serve, which leads to economic revitalization and job opportunities,” said Bill Daley, vice chairman of Public Affairs at Wells Fargo. “So many communities have suffered over the past year. MDIs need capital, but they can also benefit from access to other resources, and Wells Fargo is committed to building lasting, strategic relationships with these institutions in support of their goals.”

Today’s announcement includes investments in the following institutions:

- Broadway Federal Bank*, in Los Angeles, California

- Carver Federal Savings Bank, in New York, New York

- Citizens Savings Bank & Trust, in Nashville, Tennessee

- Commonwealth National Bank, in Mobile, Alabama

- M&F Bank, in Durham, North Carolina

- Optus Bank, in Columbia, South Carolina

“February is Black History Month, and we are proud to announce these investments at this time because they reflect our dedication to helping African American communities, many of which continue to fight the destructive economic impact of the pandemic. Wells Fargo wants to help drive stabilization and recovery by using our financial resources and our ability to act as a partner in order to generate better outcomes,” said Kleber Santos, head of Diverse Segments, Representation & Inclusion at Wells Fargo.

Wells Fargo’s financial commitments are in the form of critical equity capital, which is foundational to the MDIs’ ability to expand lending and deposit-taking capacity in their communities. The investments, primarily non-voting positions, are designed to enable the banks to maintain their MDI status. Wells Fargo is also supporting each MDI’s development through a banking relationship in the form of a single touchpoint coverage model that will help them access Wells Fargo’s

© 2021 Wells Fargo Bank, N.A. All rights reserved. For public use.

expertise and pursue strategic priorities like entering new markets, expanding locations, designing new products, and hiring staff to support loan growth.

“The investment and support from Wells Fargo will allow us to substantially increase our impact on closing the racial wealth gap. We are grateful and committed to ensuring that this capital helps drive transformational wealth building opportunities for our communities and customers,” said Dominik Mjartan, president and CEO of Optus Bank.

External partners that assisted Wells Fargo include the National Bankers Association (NBA) and Sullivan & Cromwell. External advisory committee members are Kim D. Saunders, president and CEO of NBA; Aron Betru, managing director of the Center for Financial Markets at Milken Institute; and John W. Rogers, Jr., chairman, co-CEO, and CIO of Ariel Investments.

Wells Fargo’s financial commitment announced today complements additional initiatives that aim to serve all of our customers and communities:

∙ Wells Fargo was one of the first banks to sign the Office of the Comptroller of the Currency’s Project REACh MDI Pledge, which encourages banks to develop meaningful partnerships with MDIs to help them remain a vibrant part of the economic landscape and better promote fair, equal, and full access to financial products and services in their communities.

∙ The company’s Open for Business Fund invests all gross processing fees we received from the Paycheck Protection Program in 2020 — approximately $400 million — to nonprofits helping small businesses navigate the pandemic, with an emphasis on Black, African American, and other minority-owned small businesses, as businesses with nonwhite owners are closing at a rate faster than industry peers.

∙ The Wells Fargo Diverse Community Capital program is a $175 million program with Community Development Financial Institutions (CDFIs) to provide capital and technical assistance for diverse small business owners in the U.S. Approximately 75% of awardees are led by leaders from underrepresented communities. The DCC program has enabled CDFIs to lend nearly $350 million to Black and African American small business owners across the country since the program launched in 2015, according to Opportunity Finance Network.

∙ In the 10 years spanning 2009 to 2018, Wells Fargo was the No. 1 financier of home loans to African Americans and originated more mortgages to help Black buyers purchase homes than the four other largest bank lenders combined.

∙ In 2017, the company pledged to create 250,000 Black homeowners by 2027 through lending $60 billion for home purchases, increasing the diversity of the sales team, and supporting homebuyer education and counseling. In the first three years of the commitment, 60,527 African American homeowners have been created with $15.2 billion in financing.

∙ Wells Fargo is donating $5.4 million in grants to 15 legal assistance organizations across the U.S. that work to keep people and families housed through services and advocacy efforts. This first-of-its-kind effort seeks to enable these nonprofit organizations to provide free or low-cost legal representation to people at risk of eviction. These organizations have track records of serving, on average, more than 60% people of color.

*Broadway is expected to merge with City First Bank in early 2021 and will become the largest African American MDI. Wells Fargo’s investment will close upon completion of the merger.

About Wells Fargo Community Lending and Investment

Wells Fargo Community Lending and Investment (CLI) specializes in offering debt and equity capital to organizations that provide economic development, job creation, and affordable housing in communities of need nationwide. It is primarily focused on economic redevelopment and housing development nationwide, and is the No. 1 Affordable Housing Investor in the country and No. 2 Affordable Housing Lender. In 2019, CLI provided more than $4.3 billion in capital commitments,

via New Markets Tax Credits, Low-Income Housing Tax Credits, Community Development Financial Institutions, and construction lending.

About Wells Fargo

Wells Fargo & Company is a leading financial services company that has approximately $1.9 trillion in assets and proudly serves one in three U.S. households and more than 10% of all middle market companies in the U.S. We provide a diversified set of banking, investment and mortgage products and services, as well as consumer and commercial finance, through our four reportable operating segments: Consumer Banking and Lending; Commercial Banking; Corporate and Investment Banking; and Wealth and Investment Management. Wells Fargo ranked No. 30 on Fortune’s 2020 rankings of America’s largest corporations. In the communities we serve, the company focuses its social impact on building a sustainable, inclusive future for all by supporting housing affordability, small business growth, financial health and a low-carbon economy. News, insights and perspectives from Wells Fargo are also available at Wells Fargo Stories.

Additional information may be found at www.wellsfargo.com | Twitter: @WellsFargo.

Tweet